What Waiving a Home Inspection Could Cost You

What You Need to Know

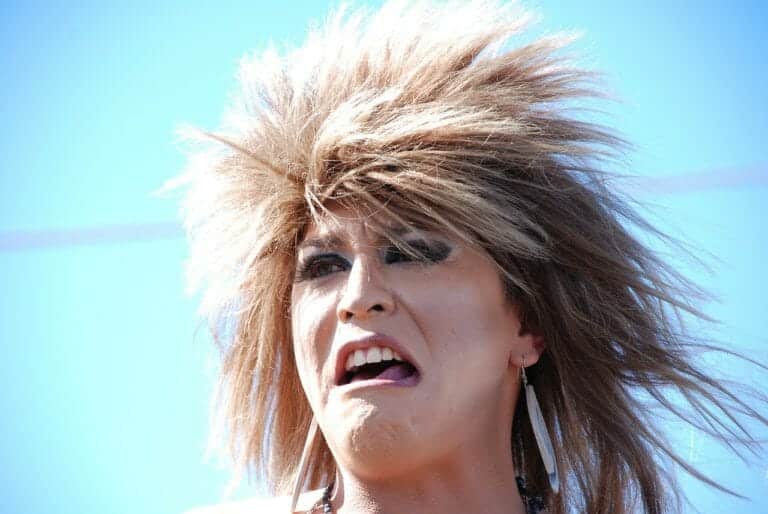

Don't Let Your Emotions Take Over...

Homebuyers usually make a purchase offer that is contingent on a good home inspection. Dependent on the type of loan, home inspections aren’t always required but they’re highly recommended because they provide a true picture of a home’s condition. On the surface, a home may appear attractive, but there may be extensive and/or costly repairs hidden inside.

In today’s market, it’s easy to get carried away – especially after seeing so many homes. Experiencing the frustration of losing out to other “better” offers… But don’t let those frustrations guide you into waiving your home inspection.

Did you know a recent study showed 75% of homebuyers regretted purchasing their home due to unplanned costs associated with maintenance and repairs?

But What is a Home Inspection?

Think of it as a quality control inspection for your future home. A home inspection is a non-intrusive inspection. Therefore, it is not destructive by nature. Your home inspector cannot open up walls or move items etc… They will, however, inspect the visible components of the house’s electrical, plumbing, and HVAC systems, as well as the roof, foundation, attic, and other structures, to look for any potential problems.

These inspections also involve a thorough examination of the home’s appliances (stove, washer/dryer, refrigerator, and water heater) to ensure that they are in good working conditions.

The Risks Involved and Potential Costs of Waiving A Home Inspection

If you’re trying to buy a house in a competitive market and your offers are getting rejected, you might feel compelled to take drastic actions. Some buyers would agree to waive inspections in exchange for more than the asking price or a rapid closure. However, this is a bad idea. The property may appear to be in great condition, but there can be significant issues hiding beneath the surface that are not readily identifiable. Often, it is these hidden issues that are the most costly to repair or even maintain insurance on a home.

You don’t want to buy a home without having it thoroughly inspected, no matter how desperately you want it or how emotionally committed you are to it. Consider six months from now, when you’ve completed the sale and moved into your new house. When you go to turn on the HVAC and it doesn’t work, or there’s a roof leak now above the kitchen sink that was painted over by the seller… or find extensive mold, insect damage, or structural foundation issues. Guess who owns those problems and the repairs now.

The Market is Crazy... We Get It

You might not be able to see or think properly when you’re in the middle of a bidding war or in your seventh month of house hunting. It’s frustrating for sure… But, don’t lose focus. You can lose a lot of money if you skip a home inspection OR you can choose to hire a qualified home inspector to help you navigate your inspection period.

A certified home inspector can help you spot potential issues with your new house. Your inspector may find evidence of water damage or mold, for example. A professional home inspection will reveal the true condition of your new home’s roof or that your water heater or air conditioner may need to be replaced soon.

Negotations aren't Dead... Even in this market

Defects discovered during a home inspection aren’t uncommon. If issues are discovered during your home inspection, the typical inspection contingency allows you to negotiate with the seller or walk away from a money-pit. Work closely with your realtor and your home inspector during this period to ensure you’re making informed decisions. Check out our Top Real Estate Agents here in Central Florida if you’re in the market for a great agent.

When both sides desire to make a deal, these types of problems are usually resolved by the seller agreeing to make repairs or by crediting the buyer with a price reduction. If you can’t reach an agreement, the inspection contingency permits you to keep your deposit if you can’t reach an agreement.

Ultimately, once you close on the property you incur full financial liability for whatever condition the property is in and whatever repairs are required. That’s something to keep in mind if you waive your inspection contingency. Sometimes the solution is straightforward and affordable. However, if significant defects are present within the home, what you don’t know could add thousands, if not tens of thousands, to the total cost of purchasing that house.