How to Lower Your Home Insurance Rates in Florida

Understanding Rising Rates in Florida

What is Driving The Rate Increases?

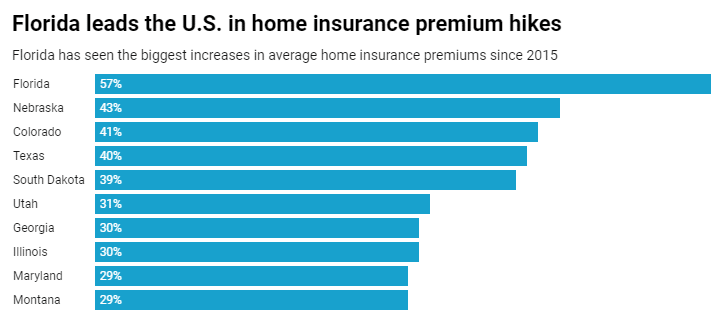

Florida homeowners face increasing home insurance rates, significantly higher than the national average. Some of the contributing factors include the more intense and frequent hurricanes. Additionally, inflation driving up construction and repair costs, and higher interest rates affecting insurance and reinsurance companies. The extensive damage caused by recent hurricanes like Irma, Michael, and Ian has cost insurance companies significant losses, further straining the insurance market(“”).

Tips to Lowering Your Insurance Rate

To manage these rising costs, one of the best things you can do as a homeowner is shop around multiple insurance providers. Insurers consider multiple variables when underwriting your home, such as the age, condition of your home, and past claim history when determining rates. One of the first items an insurance agent will request is a current Four Point Inspection Report, which shows that your home is well-maintained, potentially reducing premiums, since the underwriter is assuming less risk with your property.

Wind Mitigation Inspection & Cost Savings

Another way to save significantly on your homeowner’s insurance is to have an updated Wind Mitigation inspection report assessing your home’s wind damage resistance. Homeowners who implement features like storm shutters and reinforced garage doors can qualify for additional insurance discounts, which is especially important in hurricane-prone Florida.

However, you do not need storm shutters or impact-rated windows to qualify for some savings. Having a newer roof installed, renailed to current codes, or having hurricane clips or straps in your attic can qualify you for significant savings.

Shopping For The Best Rates

When shopping for the best home insurance rates in Florida, it’s crucial to not only focus on the price but also consider the coverage and service quality. Start by comparing quotes from multiple insurance providers. Look beyond the premium costs to understand what each policy covers, especially concerning Florida-specific risks like hurricanes and flooding. Pay attention to customer reviews and the company’s claim handling reputation. Remember, a cheaper policy might not always offer comprehensive coverage or efficient claim processing, which are vital in times of need.

Conclusion

In conclusion, lowering your home insurance rates in Florida requires a proactive approach. Updated insurance reports, such as Four Point and Wind Mitigation, are the first step and are key to ensuring your home is in top condition and capable of shopping for the best rate. Moreover, shopping around for insurance is not just about finding the lowest rates but also about understanding the coverage, quality of service, and reliability of the insurer. At Tier-1 Pro Inspections, we are committed to guiding Florida homeowners through these processes with our expertise and comprehensive services, aiming to make home insurance more affordable while ensuring optimal protection.

Want More Amazing Content?

- Curious about Polybutylene Plumbing Pipes?

- Learn about common Double Lugged Neutrals and 4 Point Inspections

- Learn More About Our Veteran-Owned Company

- Curious as to what the life expectancies of your home’s components are? See our Life Expectancy Chart